Insurance Broker License Services

REQUEST A CALL BACK

Overview of Insurance Broker License

There are ample insurance-related products available in the market in current times. People might get confused before choosing to buy a suitable insurance policy for their needs. An insurance broker company guides people on choosing the right insurance product for their requirement and so, helps people in making the right financial decision. An insurance broker is kind of a middleman between the insurance company and the client requiring insurance. These insurance brokers assist people in buying the most appropriate insurance product according to their needs. To start the insurance brokerage service, any new firm needs to apply for an insurance broker license from IRDA. They also need to meet insurance broker requirements.

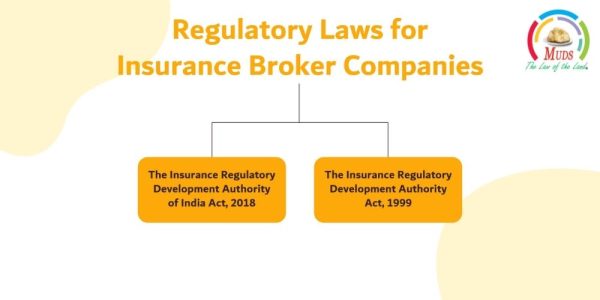

An insurance broker company acts as an intermediary between the insurance companies and the clients requiring insurance services. An insurance broker license is a prerequisite to start this kind of venture. These companies are regulated by the Insurance Regulatory and Developmental authority of India (IRDAI). Promoters willing to start an insurance broker company need to apply to IRDAI to get an Insurance broker license for their new company. At MUDS, we provide the complete range of services to promoters willing to get their insurance broker certification.

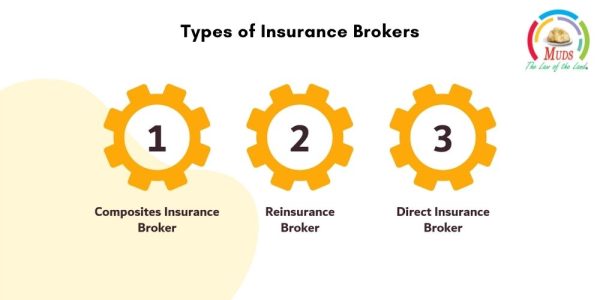

What Are Different Types of Insurance Brokers?

The insurance brokers can be broadly classified under the following three categories:

- Selling reinsurance products.

- Maintaining marketing stats of reinsurance products.

- Negotiating on behalf of the buyer before buying reinsurance product.

Regulatory Laws for Insurance Broker Companies

Eligibility Criteria to Get Insurance Broker License

Following criteria are needed to be met by a firm to get the insurance brokers license or an individual to become an insurance broker.

- A co-operative society registered under the Co-operative Societies Act, 1912.

- Any company registered through the Companies Act, 2013.

- Any person recognised by the regulatory authority.

- A Limited Liability Partnership (LLP) firm registered under the LLP Act, 2008.

For LLPs, the following are not eligible to become a partner,

(Any foreign LLP registered under the law of foreign company, non-resident entity and, any person residing outside India is not eligible to become a partner for LLPs Applying for Insurance Broker License).

| Type of Broker | Financial Requirement | Net-Worth Requirement | Deposit Requirement in a scheduled bank |

| Composite Broker | Rs. 5 Cr. | 50% of the Minimum Capital Requirement | 10% of the Minimum Capital Requirement |

| Direct Broker | Rs. 75 Lakh. | Rs. 50 Lakh. | Rs. 10 Lakh. |

| Reinsurance Broker | Rs. 4 Cr. | 50% of the Minimum Capital Requirement | 10% of the Minimum Capital Requirement |

Functions of an Insurance Broker

- Keeping track of all insurance products and businesses in the market.

- Devising risk retention strategy for customers and advising them about the appropriate insurance policy for them.

- Offering suitable quotations to clients about insurance policies.

- Devising risk management strategy for the client and keeping records of the insurer’s business.

- Advising on matters related to reinsurance markets and other matters related to insurance covers.

- Maintain a database of available insurance markets with insolvency ratings of every insurer.

- Negotiating with the reinsurance company on behalf of the customer.

Checklist and Documents Required for Insurance Broker License

This is the checklist of things a company should keep updated before applying for insurance broker registration:

Document Required To Be Submitted With The Form C Of Schedule I Of The IRDAI (Insurance Brokers) Rules 2018

Get In Touch With Us

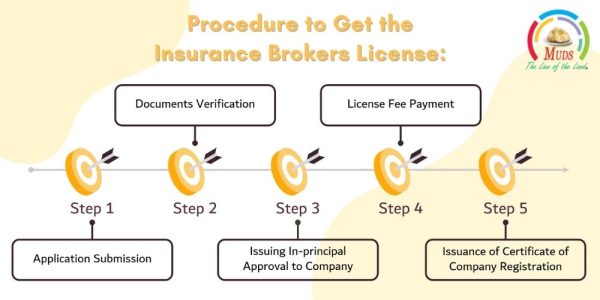

Procedure to Get the Insurance Brokers License

Step 1. Application Submission

The applicant company must submit Application Form B of Schedule I with the documents mentioned above and the necessary application fee. It also needs to submit the application form with documents to IRDAI.

Step 2. Documents Verification

IRDAI will verify the documents and could raise queries asking for more details or any other document regarding the company. If the application lacks some documents, then it will ask to submit them within 30 days of application submission.

Step 3. Issuing In-principal Approval to Company

Once all the documents are verified by IRDAI and the application satisfies all the necessary standards, then it will give in-principal approval for insurance broker company registration.

Step 4. License Fee Payment

Once the in-principal approval is achieved a company must comply by the additional requirements for getting the broker’s license and also pay the license fees to the regulatory authority.

Step 5. Issuance of Certificate of Company Registration

After meeting all the necessary compliance as necessitated by IRDAI Regulations for Insurance Broker, 2018 and verification of all the documents, the authority will grant a COR (certificate of registration) to the broker company. The certificate is issued in the FORM J of Schedule I in the IRDA regulations.

Fee for Broker’s License:

A license granted to a company is valid for 3 years and after that, it needs to be renewed by filing a renewal application. Fee for License Application is as mentioned in the table given below,

| Type of Broker License | Non-Refundable Application Fee | Registration fee for a fresh application | Renewal Fee for a period of 3 years |

| For Direct Broker | Rs. 25000 | Rs. 50000 | Rs. 100000 |

| For Reinsurance Broker | Rs. 50000 | Rs. 150000 | Rs. 300000 |

| For Composite Broker | Rs. 75000 | Rs. 250000 | Rs. 500000 |

Alternately Call our Legal Expert Now For Free Consultation at 09599653306

Principal Officer (PO) is an individual who has a higher role in the Insurance Broker Business. The PO is typically a director, shareholder, CEO, or Full-time director. These individuals perform duties associated with insurance/re-insurance business administration.

These are the categories where insurance brokers license can be granted.

- Direct Broker (Life Insurance)

- Re-insurance Broker

- Direct Broker (General Insurance)

- Composite Broker

- Direct Broker (Life Insurance & General Insurance)

The following individual or entities can’t be considered for an insurance brokerage licence:

It the entity is an LLP then they can’t apply for a license if they are,

- A Non-Resident Individual/entity.

- A Foreign Entity; and

- A foreign partnership firm registered under the laws of a foreign country.

A broker is an individual with the necessary experience and qualifications to handle the insurance brokerage business. A director can also act as a broker for any insurance business if he has the requisite qualifications to manage the insurance business.