LEARN ESOP VALUATION- BLACK SCHOLES FORMULA

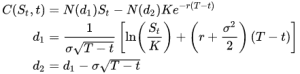

Black Scholes Formula is the most often used approach, and it is recommended for small schemes with simple rules. The formula is as follows (source: Wikipedia):

In this scenario, the variables are the share price (S), exercise price (K), volatility (sigma), time to exercise (T), and the risk-free rate (r). The most significant benefit of this technique is its accessibility. Once the variables’ data were available, the option price may be easily calculated.

The Black Scholes approach is most widely used to evaluate employee stock options in India. Organizations, on either end, must understand the restrictions and confirm that this method is suitable for their unique situation.

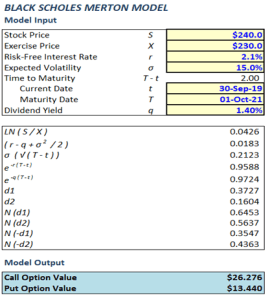

Black-Scholes-Merton Model Example with Solution

Date: 29/07/19

Jeff holds 600,000 Call Options, that enable him to acquire 600,000 Amazon Shares at a strike price of $230 per share 2 years later, on October 1, 2021 (the closing date of the Call Options).

As of now (30 September 2019), what really is the fair value of Jeff’s alternatives?

Step 1: Evaluate if the Black Scholes Model is appropriate for your appraisal.

Jeff’s Option are European Options because they vest (may only be executed) at the end of the Option life.

The Black Scholes Technique is an appropriate valuation method for European options

Step 2 – Decide on the date of valuation.

The worth of the Options will be decided as of today, September 30, 2019. (the “Valuation Date”).

Step 3: Measure the BSM Input data.

The stock price (represented by the symbol “S”)

The market price of Amazon shares should be (i.e., 30 September 2019) on the valuation period

S = $240

(represented by the symbol “X”) Exercise Price

Will be the price per share during which Jeff will be able to purchase/strike Amazon shares in the hereafter.

X equals $230

The risk-free interest rate (abbreviated “r”)

The rate of interest on a government bond is the risk-free value.

r is equal to 2.1 percent.

Volatility (represented by the symbol “”)

The projected degree of variation/fluctuation in Amazon’s share price within the next two years (i.e., over the life of the Options).

15 per cent

Maturity Time (represented by the symbols “T – t”)

The entire life of the Options (i.e., the time elapsed between the Valuation Date

(t) and the Maturity/Expiration Date

t – 30/9/2019

T – 1/10/2021

T-t = 2.0 (year)

Dividend Yield (represented by the symbol “q”) should be the predicted dividend yield from Amazon shares over the following two years (i.e., over the life of the Options).

q is equal to 1.4 per cent.

Step 4: Analyze the Results and Conduct Sensitivity Testing (if necessary)

On September 30, 2019, the value of a call option is $26.276 per option.

Jeff’s 600,000 call options are worth around $15.77 million in total.

We believe the BLACK SCHOLES FORMULA helped you understand the ESOP Valuation Procedure. Visit our website to learn more about ESOP valuation methodologies and choices.

MUDS MOST POPULAR SERVICES

ESOP Valuation ESOP Trust Formation ESOP Issuance

MUDS Management is ready to help you build and implement an ESOP plan for your company in India by providing you with the best expert guidance and service in India.