Venture Capital Funds

Today startups are have become a lucrative alternative for carving footsteps in the world of business. In the cut throat competitive business environment startups are occupying the prime imagination of the world at present. Startups come up with innovate business ideas which require financial support during the initial phases because they have high risk element during the growth process.

Though being risky the startups bestow high growth opportunities to the investors who on having faith on the business idea of startup contribute funds during the seed phase.

The funding process for startups is lengthy and split up into phases. The amount of funding that startups receive during the initial phases majorly depends on the business idea with which they come up. Since the startups are risky ventures the possibility of failure are also substantial. Though funding at seed stage may be risky but the potential for above average returns is an attractive payoff for the investors.

In this article we will discuss in detail about the venture capital funds. Before diving directly in details about the venture capital funds it is of utmost importance to understand as to what venture capital funds are.

What are They?

Venture capital funds are investment funds that manage the money of investors who seek private equity stakes in startup and small to medium sized enterprises with strong growth potential. These investments are generally characterized as high risk or high return opportunities.

Venture capital funds are private equity investment vehicles that seek to invest in firms that have high risk/high return profile determined on the basis of company’s size, assets and various stages of economic development. These are early age investment with a long term horizon.

Many of these funds make small bets on wide variety of young startups on the belief that at least one will achieve high growth and reward the funds invested with comparatively higher payout at the end.

For Whom?

Venture capitals identify promising new technology, products or concepts and thereafter provide the funding required to move the idea conceived forward.

Venture capital is the most suitable option for funding costly capital source for companies and mostly for businesses that have huge capital requirement with no other cheaper viable alternative. With the means of venture capital funding is provided to early stage, high potential and growing companies. The intent behind financing is to generate return on investment.

Venture capital funding is mainly for essential for new companies or ventures that have limited operating history of less than two years. Of late venture capital funding had become a popular rather essential source for raising capital during initial phases when there is lack to capital market , bank loans or other debt instruments.

Venture capital Funds generally comes from well of investors, investment banks and other financial institutions.it is significant to note that venture capital fund not only takes monetary form in various scenarios it may also be provided in the shape of technical or managerial expertise.

Venture capital funds ensure that the money of the investors is used to fund project which have a potential to grow. Since these firms are usually start ups these are said to have high risk/high return profiles.

Having gained an understanding about what venture capital funds are and for whom they are viable lets head toward highlighting the features of venture capital funds.

Features of Venture Capital Funds

From the above briefing of the venture capital fund, we can say that venture capital funds have the following features:

- It is a high risk investment made with the motive of reaping high profits.

- The investment sowed is based on long term goals.

- The investment is made in startups which have lucrative idea and growth prospects.

- Money is invested by investors vide purchase of equity shares in these startup companies.

- Funding is mainly granted for innovative projects.

- Since the venture capitalist purchase the equity stake of the company and so they secure the right to participate in the management of the company.

- Venture capital funds contribute to the development of new products or services and in the acquisition of latest technology.

- The biggest advantage of the venture capital funds is that they offer network opportunities thereafter leading to achievement of growth in short time span.

Due to the above highlighted features of venture capital fund these are among the most widespread alternative especially for fast growing technology and biotechnology domains.

Pros and Cons of Venture Capital Fund

Venture capital funds as initially elaborated are the investments made by the investors looking for private equity stake holding in startups, small to medium enterprises that have a growth potential.

The investment is made on account of the sole motive of “high return for higher risk”. On this note there are numerous pros and cons of venture capital fund. A few pros and cons are as follows:

- The autonomy and control of the founder declines as the investors become part owners.

- The process of venture capital funding is lengthy and complicated thereby involving high risk element.

- The object and the profit return quotient of the investment is uncertain.

- Since funding is made for long time span and so the realization of profits commences at a quite later stage.

- Thought the benefits of venture capital funding are reaped at later stage , the returns that are generated are huge

- The entrepreneurs are in a safe zone as the ventures do not run on the obligation to repay the money invested as the investors are well versed with the uncertainty elements involved in the business.

Abhishek Jain at MUDS is of the view that “Venture capital funding is the funding provided to companies and entrepreneurs during the different phases of their evolution. Venture capital funding has evolved from root level and in today’s time plays an important role in spurring innovation.”

Structure of Venture Capital Fund

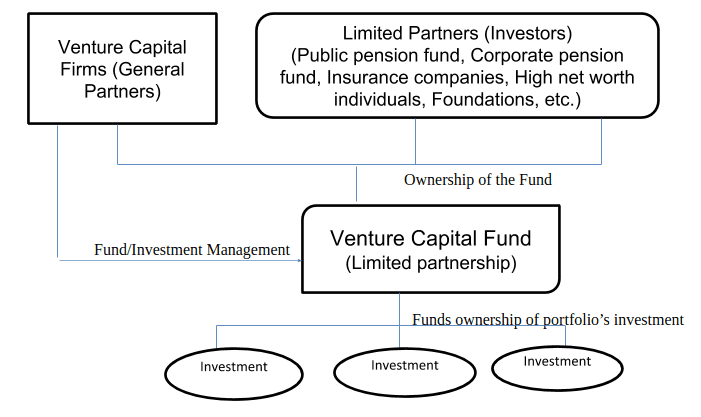

Venture capital funds are mainly structured as partnerships. The general partners of such partnership firm serve as the managers of the firm as well as they play the role of investment advisors for the venture capital fund.

The venture capital funds may also be structured as limited liability companies. In the case of limited liability companies the investors in the venture capital fund are known as limited partners.

The major contributories of the venture capital fund consist of high net worth individuals and institutions with large capital base such as state & Private Pension fund, foundations, insurance companies and pool investment vehicles.

Within the venture capital industry, the general partners and other investment professionals are of the venture capital firm are often referred to as venture capitalist (VCs). The Venture Capitalists are usually from operational or finance background.

The general partners run the venture capital firm and make the investment decisions on behalf of the fund. The venture partners are expected to source potential investment opportunities and are thereafter compensated for only those deals in which they are involved.

After the general partners and venture partners are Principals, Associates and Entrepreneurs in residence. These persons are experience holders in the domain of investment banking, management consultancy and due diligence.

Having gained an insight about the structure of the venture capital fund, leads head towards understanding the other facets related to these venture capital fund.

Life of Venture Capital Fund

Venture capital funds usually have a fixed life span of around 10 years, with the possibility of few years of extension to allow for private companies still seeking liquidity. The investment phase for most of the funds ranges between three to five years, after which the point of focus moves to management and follow on investments in existing portfolio.

In these funds, the investors have a fixed commitment to the fund that is initially unfunded and subsequently called own by the venture capital fund over a span of time once the fund commences to make investments. There are substantial penalties for limited partners or investors who fail to participate in capital call.

It may take around a month or numerous years for venture capitalists to raise money from limited partners for meeting the funding requirements. Once the required funds have been raised then the fund is closed and thereafter commences the 10 years lifetime. Some funds are partially closed when half or higher amount of the funds have been raised.

How Venture Capital Funds Operate?

Based on the maturity of the business for which the investment is done, venture capital investments can be seen as early stage capital, seed capital or expansion stage financing. However, the investment stage has no effect on how the venture capital funds operate.

To begin with, before making any investments venture capital funds have to raise funds. For meeting the funding requirement potential investors are given a prospectus of the fund after which they provide commitment to contribute to the funding process. Once commitments are received from the potential investors the fund’s operators connect with the shortlisted potential investors and thereby finalize the individual investment amount for the potential investors.

Once the investment amount are finalized then the private equity investment that have potential of generating positive returns for its investors are sorted out by the venture capital fund.

To sort out the potential investment the fund managers have to review numerous business plans to find out high growth companies. Thereafter the viable investment decisions are made by thee fund managers keeping into account the prospectus and expectations of shareholders.

In the scenario where a portfolio company exists then in such a case the investors of the venture capital fund make returns either in mergers & acquisitions or in an IPO. If the investment reaps profit then the venture capital fund keeps a certain percentage of profit

Types of Venture Capital Fund

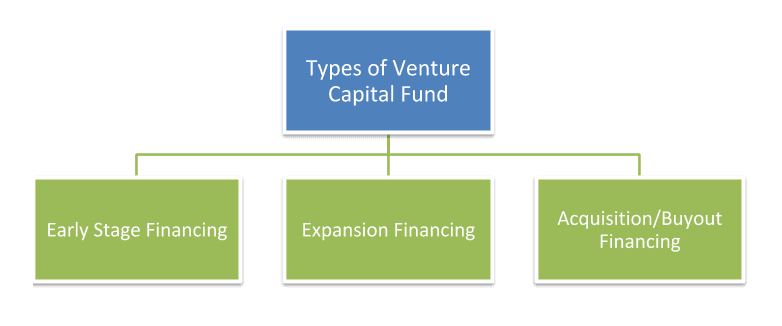

Venture capital funds are classified on the basis of their utilization at different stages of a business. The three main types are early stage financing, expansion financing and acquisition/buyout financing.

Early Stage Financing

There are 3 further bifurcations in early stage financing. These are Seed financing, Startup financing and First stage financing.

Seed financing is a small sum of money provided to the entrepreneur to meet the initial startup loan requirement.

Startup financing is the funding round wherein company receives the funds to develop its products and services.

The last phase of early stage financing i.e. first stage financing is when company needs the capital to commence the business activities in full swing.

Expansion Financing

Expansion financing is classified into three streams. These are Second stage financing, Third stage financing and Bridge financing.

The second stage and third stage financing are given to companies with the intent that they may they may initiate their expansion phase.

Bridge financing is offered to companies during the course of Initial Public Offering (IPO).

Acquisition/Buyout Phase

Acquisition financing and leveraged buyout financing are the categories falling under acquisition/buyout financing.

Acquisition financing comes into picture during the course when a company requires fund to acquire another company or part of the company.

Leveraged buyout financing is required when group of companies seek to acquire any other company’s specific product.

Process for Venture Capital Funding

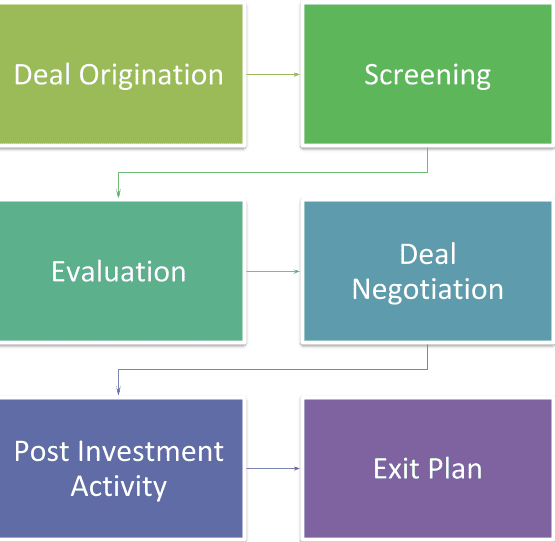

Venture capital funding is generally done by following the below mentioned steps. The funding steps are as follows:

1. Deal Origination

The primary step to attract venture capital funding is origination of deal. For making or seeking funding the investor needs to crack the deal with the appropriate party. For seeking funding one needs to enter into series of deals after which expected deal is closed. The deal may come from numerous sources depending upon the of the fund requirement.

2. Screening

This is the phase where after cracking the deal with the investor, the venture capitalist chalks out the viable projects in which making investment would be viable as well as profitable. The projects are shortlisted keeping into consideration several factors like market scope, technology, size of investment, geographical location, stage of financing, etc. During this phase the potential entrepreneurs are required to provide a brief profile of their respective venture or are invited for a face to face discussion.

3. Evaluation

Once the screening process is over thereafter the projects are evaluated via a detailed study. The evaluation process is a detailed and thorough process wherein the project capacity as well as the capacity of the entrepreneurs to meet up the claim is analyzed. The documents to be viewed during evaluation are: projected profile, track record of the investors, future turnover expectation, etc. After evaluation of the projects an extensive risk management is done after which deal negotiation is undertaken.

4. Deal Negotiation

Once the potential projects have been shortlisted by the venture capitalist then he enters the deal negotiation stage. Deal negotiation is a process wherein the terms and conditions are laid down keeping into account the mutual benefit. Some of the factors which are negotiated are : amount of investment, percentage of profit to be held by the parties, the rights of the venture capitalist and the entrepreneurs, etc.

5. Post Investment Activity

Once the deal gets finalized, the venture capitalist also becomes a part of the venture and thereafter up his part of the rights and duties. The venture capitalist participates in the enterprise via a representation in the board of directors and thereby ensures that the enterprise acts in accordance with the plan. However the capitalist do not take part in the day to day activities of the firm and have a role to play during the course of financial risks.

6. Exit Plan

The last step of venture capital funding is to lay out an exit plan based on the nature of investment, extent& type of investment stake etc. The exit plan is drafted with the aim to minimize losses and maximize profits.

Procedure for Registration of Venture Capital Fund

The registration of venture capital fund is regulated by SEBI (Venture Capital Fund) Regulations, 1996. On this note any company or trust proposing to carry on an activity as venture capitalist may make an application to SEBI for grant of certificate.

Eligibility Criteria

A company, trust and a body corporate can apply to SEBI for seeking certificate to carry on activity as venture capitalist. In light of this the eligibility criteria are as follows:

For Company

- The Memorandum of Association (MOA) should reflect the activity of venture capital fund.

- The company seeking certificate should be prohibited to make any invitation to public for subscribing its securities via its memorandum and articles of association

- The directors and officers of the company should not be involved in any litigation having connection with securities market.

- The company seeking registration should be a fit and proper person.

For Trust

- The main object of the trust should be to carry the activity as venture capital fund.

- The instrument of NGO registration should be in the form of deed and thereby duly registered under Indian Registration Act, 1908.

- The directors of the trust should not be involved in any litigation connected with securities market or convicted of any offence involving moral turpitude.

- The trust should be a fit and proper person.

For Body Corporate

- The body corporate should be set up under the laws of the central or state legislature.

- The applicant should be permitted to carry on the activity of venture capitalist

- The directors of the body corporate should not be involved in any litigation connected with the securities market or convicted of any offense involving moral turpitude.

- The applicant should not have been refused a certificate at any time by the board.

- The applicant should be a fit and proper person.

How to Apply?

An application for grant of certificate of registration shall be made with the board in Form A which shall be accompanied with a non-refundable fee of Rs. 1 lakh.

The board may in the interest of the investors issue required directions for transfer of records, documents or securities of disposal of investments in relation to the venture capital activities.

On receipt of the intimation, the applicant shall pay to the board the registration fee of Rs. 10 lakhs. The board on receipt of the fee shall thereafter grant a certificate of registration in Form B.

Documents to be Filed

The documents to be filed for seeking a certificate of registration are as follows:

- Information Memorandum

- Copy of Placement Memorandum

- Copy of Contribution or Subscription Agreement

- Report of money actually collected from investors

The board before ordering an inspection shall not give less than 10 days’ notice to the venture capital fund. During the course of inspection, the venture capital fund shall be bound to discharge its obligations. The inspecting officer shall upon completion of inspection submit an investigation or inspection report to the board.

Fees

- Application Fee: Rs. 1, 00,000/-

- Registration Fee: Rs. 10, 00,000/-

Minimum Investment Criteria

- A venture capital fund can raise funds from any investor whether Indian, foreign or non-resident Indians.

- No venture capital fund be it company or trust shall accept any investment from any investor which is less than Rs. 5 lakhs.

- The Scheme launched shall have a commitment from the investors for the contribution of an amount of atleast Rs. 5 Crore.

Investment Conditions

- It shall disclose the investment strategy at the time of putting forth the application.

- It shall not invest more than 25% Corpus of the fund in one venture capital undertaking.

- It may invest in securities issued by the foreign companies subject to RBI norms specified in this behalf.

- Shall not invest in associated companies.

- It shall disclose the duration of life cycle of the fund.

- No venture capital fund shall be entitled to get its units listed till the expiry of 3 years from the date of issuance of units by the venture capital fund.

- It shall make investment in the following manner :

- Atleast 66.67% of investible funds shall be invested in unlisted equity shares.

- Not more than 33.33% of the investible funds may be invested by way of either of the following i.e. subscription to IPO of a venture capital fund whose shares are proposed to be listed; debt or debt instruments of a venture capital fund; Preferential allotment of equity shares of listed company provided that they have a lock in period of 1 year, Equity shares of a financially weak or sick company who are listed or Special purpose vehicle created by venture capital fund for the purpose of promoting investment.

Venture capital financing gained its roots in India in the year 1988 with the formation of the Technology Development

and Information Company of India Ltd. (TDICI) that was promoted by ICICI and UTI. The first venture capital fund was sponsored by Credit Capital Finance Corporation (CFC) and thereafter promoted by Bank of India, Asian Development Bank and Commonwealth Development Corporation i.e. Credit Capital Venture Fund.

At the same time Gujarat Venture Finance Ltd. and APIDC Venture Capital Fund Ltd. were started by state level financial institutions. The sources from which these funds gained momentum were financial institutions, foreign institutional investors or pension funds and high net worth individuals.

In India, the venture capital fund has played and is playing a vital role in the development and growth of innovative and budding entrepreneurs. At the onset the venture capital funding was done by only a few institutions to promote entities in private sector in their business.

At that time funds were primarily raised by public which did not prove out to be fruitful in the long run and in the interest of small entrepreneurs. Keeping into purview the need of the hour, the venture capital funds were recognized in the 7th five year plan and thereafter in the long term fiscal policies of the government of India.

The outstanding factor about venture capital funding is the cache of being associated with well-known firms, the guidance offered by veteran entrepreneurs and the most important of all the infusion of cash without the need of paying back the infused funds.

Hope this article was informative in providing detailed insight about venture capital funds.